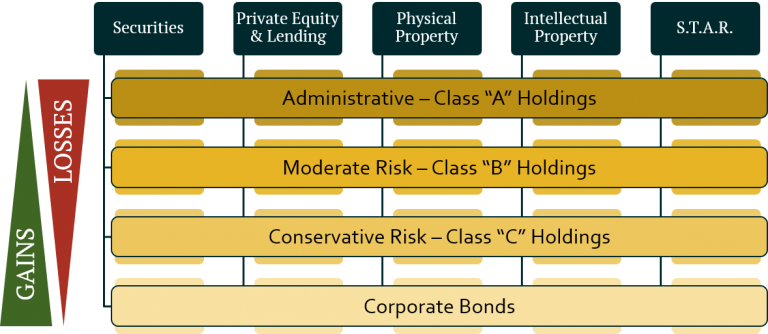

Our “5-Funds” Approach

A CAPITAL & Risk management program with your needs in mind

Currently, Templar Investment Group is the only firm of its kind to protect its non-managing limited partners interests by shielding their deposits with our own administratively-required holdings.

At the core of our business is our “5-Funds” Approach.

How It Works

< —-The 5 Funds —->

YOU get to choose how much risk you are ready to take on

Our diverse portfolio will keep you protected!

Templar Core Model

Equity Classes Tiered from Highest to Lowest Risk Exposure

Class “A” Holdings

Principally Designed for Firm Mandated Administrative Holdings and High Net-Worth Depositors*

Class “A” holdings comprise a minimum of 10% of the total value of the Templar portfolio. Class “A” interests are classified as the most risk tolerant positions. In exchange for providing protection against principal loss to all subordinate tiers, classes, and debts, Class “A” holdings are awarded insulation fees, paid from the gains of subordinate Classes and Tiers, in addition to the gains owed commensurate to principal contribution. Owners of Class “A” interests possess the greatest voting strength of all Classes (as defined in the Member Agreement/Prospectus).

Class “B” Holdings

Principally Designed for Small Business, Financial Intermediaries, and General Membership Accounts*

Class “B” holdings comprise a minimum of 20% of the total value of the Templar portfolio. Class “B” interests are classified as having a “moderate” risk profile*. In exchange for providing protection against principal loss to subordinate Tiers, Class “C” holdings, and debts, Class “B” holdings are awarded insulation fees from the more conservative positions and gains owed commensurate to principal contribution. Owners of Class “B” interests possess a voting strength subordinate only to Class “A” (as defined in the Member Agreement/Prospectus).

*As determined by an internal scoring metric, calculated at enrollment, that assesses new member risk tolerance in relation to the current partnership.

Class “C” Holdings

Principally Designed for Institutional Equity Positions*

Class “C” holdings comprise a minimum of 30% of the total value of the Templar portfolio. Class “C” interests are classified as having a “conservative” risk profile*. Class “C” holdings only provide protection against principal loss to subordinate tiers and debts. Class “C” holdings are not awarded insulation fees but do earn a percentage gainshare commensurate to principal contribution. Owners of Class “C” interests possess the lowest individual voting strength but contain the highest number of Class positions (as defined in the Member Agreement/Prospectus).

*As determined by an internal scoring metric, calculated at enrollment, that assesses new member risk tolerance in relation to the current partnership.

Corporate Bonds

Company Issued Debt Offerings

Templar Corporate Bonds represent a formal agreement between Templar and the debt holder to repay the amount deposited by the debt holder, plus an agreed upon rate of interest (i.e. the coupon) at the conclusion of a predetermined period of time (i.e. maturity date). As a matter of company policy, the total outstanding corporate debt issued by Templar Investment Group, LLC can never exceed 33% of the firm’s total portfolio value.

*Contingent on total portfolio value and size, class capacity, and market activity

Our Partnerships

Our model is put to work through our four different service categories

Institutional

Reconnecting our Community in a Socially-Conscious and Fiscally Responsible way

public

Putting our Organizational Management Expertise and Financial Resources to Work for You